Demand for oil

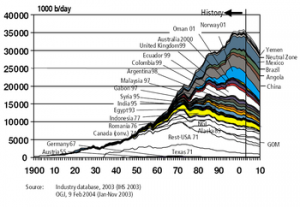

Petroleum: top consuming nations, 1960-2006.

The world increased its daily oil consumption from 63 million barrels (10,000,000 m3) (Mbbl) in 1980 to 85 million barrels (13,500,000 m3) in 2006.

The demand side of peak oil is concerned with the consumption over time, and the growth of this demand. World crude oil demand grew an average of 1.76% per year from 1994 to 2006, with a high of 3.4% in 2003-2004. After reaching a high of 85.6 million barrels (13,610,000 m3) per day in 2007, world consumption decreased in both 2008 and 2009 by a total of 1.8%, due to rising fuel costs.[13] Despite this lull, world demand for oil is projected to increase 21% over 2007 levels by 2030 (104 million barrels per day (16.5×106 m3/d) from 86 million barrels (13.7×106 m3)), due in large part to increases in demand from the transportation sector.[14][15][16] A study published in the journal Energy Policy predicted demand would surpass supply by 2015 (unless constrained by strong recession pressures caused by reduced supply).[9]

Energy demand is distributed amongst four broad sectors: transportation, residential, commercial, and industrial.[17][18] In terms of oil use, transportation is the largest sector and the one that has seen the largest growth in demand in recent decades. This growth has largely come from new demand for personal-use vehicles powered by internal combustion engines.[19] This sector also has the highest consumption rates, accounting for approximately 68.9% of the oil used in theUnited States in 2006,[20] and 55% of oil use worldwide as documented in the Hirsch report. Transportation is therefore of particular interest to those seeking to mitigate the effects of peak oil.

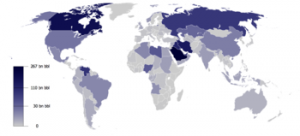

Although demand growth is highest in the developing world,[21] the United States is the world’s largest consumer of petroleum. Between 1995 and 2005, U.S. consumption grew from 17,700,000 barrels per day (2,810,000 m3/d) to 20,700,000 barrels per day (3,290,000 m3/d), a 3,000,000 barrels per day (480,000 m3/d) increase. China, by comparison, increased consumption from 3,400,000 barrels per day (540,000 m3/d) to 7,000,000 barrels per day (1,100,000 m3/d), an increase of 3,600,000 barrels per day (570,000 m3/d), in the same time frame.[22]

United States oil production peaked in 1970. By 2005 imports were twice the production.

As countries develop, industry and higher living standards drive up energy use, most often of oil. Thriving economies such as China and India are quickly becoming large oil consumers.[23] China has seen oil consumption grow by 8% yearly since 2002, doubling from 1996-2006.[21] In 2008, auto sales in China were expected to grow by as much as 15-20%, resulting in part from economic growth rates of over 10% for 5 years in a row.[24]

Although swift continued growth in China is often predicted, others predict that China’s export dominated economy will not continue such growth trends due to wage and price inflation and reduced demand from the United States.[25] India’s oil imports are expected to more than triple from 2005 levels by 2020, rising to 5 million barrels per day (790×103 m3/d).[26]

The International Energy Agency estimated in January 2009 that oil demand fell in 2008 by 0.3%, and that it would fall by 0.6% in 2009. Oil consumption had not fallen for two years in a row since 1982-1983.[27]

The Energy Information Administration (EIA) estimated that the United States’ demand for petroleum-based transportation fuels fell 7.1% in 2008, which is “the steepest one-year decline since at least 1950.” The agency stated that gasoline usage in the United States may have peaked in 2007, in part due to increasing interest in and mandates for use of biofuels and energy efficiency.[28][29]

The EIA now expects global oil demand to increase by about 1,600,000 barrels per day (250,000 m3/d) in 2010. Asian economies, in particular China, will lead the increase.[30] China’s oil demand may rise more than 5% compared with a 3.7% gain in 2009, the CNPC said.[31]

Population

Another significant factor on petroleum demand has been human population growth. Oil production per capita peaked in 1979.[32] The United States Census Bureau predicts that the world population in 2030 will be almost double that of 1980.[33] Author Matt Savinar predicts that oil production in 2030 will have declined back to 1980 levels as worldwide demand for oil significantly out-paces production.[34][35] Physicist Albert Bartlett argues that the decline of the rate of oil production per capita has gone undiscussed because population control is considered politically incorrect by some.[36]

Oil production per capita has declined from 5.26 barrels per year (0.836 m3/a) in 1980 to 4.44 barrels per year (0.706 m3/a) in 1993,[33][37] but then increased to 4.79 barrels per year (0.762 m3/a) in 2005.[33][37] In 2006, the world oil production took a downturn from 84.631 to 84.597 million barrels per day (13.4553×106 to 13.4498×106 m3/d) although population has continued to increase. This has caused the oil production per capita to drop again to 4.73 barrels per year (0.752 m3/a).[33][37]

One factor that has so far helped ameliorate the effect of population growth on demand is the decline of population growth rate since the 1970s. In 1970, the population grew at 2.1%. By 2007, the growth rate had declined to 1.167%.[38]However, oil production was, until 2005, still outpacing population growth to meet demand. World population grew by 6.2% from 6.07 billion in 2000 to 6.45 billion in 2005,[33] whereas according to BP, global oil production during that same period increased from 74.9 to 81.1 million barrels (11.91×106 to 12.89×106 m3), or by 8.2%.[39] or according to EIA, from 77.762 to 84.631 million barrels (12.3632×106 to 13.4553×106 m3), or by 8.8%.[37]

Agricultural effects and population limits

Since supplies of oil and gas are essential to modern agriculture techniques, a fall in global oil supplies could cause spiking food prices and unprecedented famine in the coming decades.[40][note 1] Geologist Dale Allen Pfeiffer contends that current population levels are unsustainable, and that to achieve a sustainable economy and avert disaster the United States population would have to be reduced by at least one-third, and world population by two-thirds.[41][42]

The largest consumer of fossil fuels in modern agriculture is ammonia production (for fertilizer) via the Haber process, which is essential to high-yielding intensive agriculture. The specific fossil fuel input to fertilizer production is primarily natural gas, to provide hydrogen via steam reforming. Given sufficient supplies of renewable electricity, hydrogen can be generated without fossil fuels using methods such as electrolysis. For example, the Vemork hydroelectric plant in Norway used its surplus electricity output to generate renewable ammonia from 1911 to 1971.[43]

Iceland currently generates ammonia using the electrical output from its hydroelectric and geothermal power plants, because Iceland has those resources in abundance while having no domestic hydrocarbon resources, and a high cost for importing natural gas.[44]

Supply of oil

Discoveries

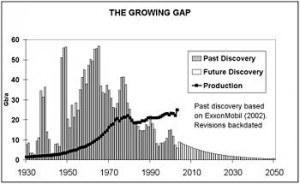

Growing gap between discovery and production

| “ |

All the easy oil and gas in the world has pretty much been found. Now comes the harder work in finding and producing oil from more challenging environments and work areas. |

” |

|

— William J. Cummings, Exxon-Mobil company spokesman, December 2005[45]

|

| “ |

It is pretty clear that there is not much chance of finding any significant quantity of new cheap oil. Any new or unconventional oil is going to be expensive. |

” |

|

— Lord Ron Oxburgh, a former chairman of Shell, October 2008[46]

|

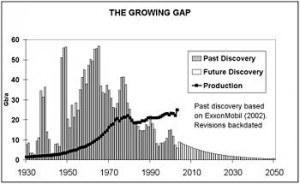

To pump oil, it first needs to be discovered. The peak of world oilfield discoveries occurred in 1965[47] at around 55 billion barrels (8.7×109 m3)(Gb)/year.[48] According to the Association for the Study of Peak Oil and Gas (ASPO), the rate of discovery has been falling steadily since. Less than 10 Gb/yr of oil were discovered each year between 2002-2007.[49] According to a 2010 Reuters article, the annual rate of discovery of new fields has remained remarkably constant at 15-20 Gb/yr.[50]

Reserves

2004 U.S. government predictions for oil production other than in OPEC and the former Soviet Union.

Total possible conventional crude oil reserves include all crude oil with 90-95% certainty of being technically possible to produce (from reservoirs through a wellbore using primary, secondary, improved, enhanced, or tertiary methods), all crude with a 50% probability of being produced in the future, and discovered reserves which have a 5-10% possibility of being produced in the future. These are referred to as 1P/Proven (90-95%), 2P/Probable (50%), and 3P/Possible (5-10%).[51] This does not include liquids extracted from mined solids or gasses (oil sands, oil shales, gas-to-liquid processes, or coal-to-liquid processes).[52]

Many current 2P calculations predict reserves to be between 1150-1350 Gb, but because of misinformation, withheld information, and misleading reserve calculations, it has been reported that 2P reserves are likely nearer to 850-900 Gb.[5][9] Reserves in effect peaked in 1980, when production first surpassed new discoveries, though creative methods of recalculating reserves have made this difficult to establish exactly.[5]

Current technology is capable of extracting about 40% of the oil from most wells. Some speculate that future technology will make further extraction possible,[53][verification needed] but this future technology is usually already considered in Proven and Probable (2P) reserve numbers.

In many major producing countries, the majority of reserves claims have not been subject to outside audit or examination. Most of the easy-to-extract oil has been found.[45] Recent price increases have led to oil exploration in areas where extraction is much more expensive, such as in extremely deep wells, extreme downhole temperatures, and environmentally sensitive areas or where high technology will be required to extract the oil. A lower rate of discoveries per explorations has led to a shortage of drilling rigs, increases in steel prices, and overall increases in costs due to complexity.[54][55]

Concerns over stated reserves

| “ |

[World] reserves are confused and in fact inflated. Many of the so-called reserves are in fact resources. They’re not delineated, they’re not accessible, they’re not available for production. |

” |

|

|

Al-Husseini estimated that 300 billion barrels (48×109 m3) of the world’s 1,200 billion barrels (190×109 m3) of proven reserves should be recategorized as speculative resources.[6]

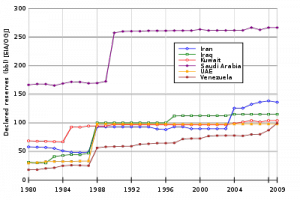

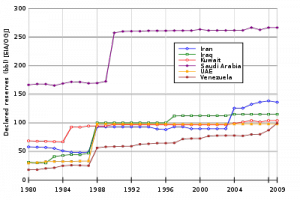

Graph of OPEC reported reserves showing refutable jumps in stated reserves without associated discoveries, as well as the lack of depletion despite yearly production.

One difficulty in forecasting the date of peak oil is the opacity surrounding the oil reserves classified as ‘proven’. Many worrying signs concerning the depletion of proven reserves have emerged in recent years.[56][57] This was best exemplified by the 2004 scandal surrounding the ‘evaporation’ of 20% of Shell’s reserves.[58]

For the most part, proven reserves are stated by the oil companies, the producer states and the consumer states. All three have reasons to overstate their proven reserves: oil companies may look to increase their potential worth; producer countries gain a stronger international stature; and governments of consumer countries may seek a means to foster sentiments of security and stability within their economies and among consumers.

Major discrepancies arise from accuracy issues with OPEC’s self-reported numbers. Besides the possibility that these nations have overstated their reserves for political reasons (during periods of no substantial discoveries), over 70 nations also follow a practice of not reducing their reserves to account for yearly production. Analysts have suggested that OPEC member nations have economic incentives to exaggerate their reserves, as the OPEC quota system allows greater output for countries with greater reserves.[53]

Kuwait, for example, was reported in the January 2006 issue of Petroleum Intelligence Weekly to have only 48 billion barrels (7.6×109 m3) in reserve, of which only 24 were fully proven. This report was based on the leak of a confidential document from Kuwait and has not been formally denied by the Kuwaiti authorities. This leaked document is from 2001,[59] so the figure includes oil that has been produced since 2001, roughly 5-6 billion barrels (950×106 m3),[22] but excludes revisions or discoveries made since then. Additionally, the reported 1.5 billion barrels (240×106 m3) of oil burned off by Iraqi soldiers in the First Persian Gulf War[60] are conspicuously missing from Kuwait’s figures.

On the other hand, investigative journalist Greg Palast argues that oil companies have an interest in making oil look more rare than it is, to justify higher prices.[61] This view is contested by ecological journalist Richard Heinberg.[62] Other analysts argue that oil producing countries understate the extent of their reserves to drive up the price.[63]

In November 2009, a senior official at the IEA alleged that the United States had encouraged the international agency to manipulate depletion rates and future reserve data to maintain lower oil prices.[64] In 2005, the IEA predicted that 2030 production rates would reach 120,000,000 barrels per day (19,000,000 m3/d), but this number was gradually reduced to 105,000,000 barrels per day (16,700,000 m3/d). The IEA official alleged industry insiders agree that even 90 to 95,000,000 barrels per day (15,100,000 m3/d) might be impossible to achieve. Although many outsiders had questioned the IEA numbers in the past, this was the first time an insider had raised the same concerns.[64] A 2008 analysis of IEA predictions questioned several underlying assumptions and claimed that a 2030 production level of 75,000,000 barrels per day (11,900,000 m3/d) (comprising 55,000,000 barrels (8,700,000 m3) of crude oil and 20,000,000 barrels (3,200,000 m3) of both non-conventional oil and natural gas liquids) was more realistic than the IEA numbers.[7]

The EUR reported by the 2000 USGS survey of 2,300 billion barrels (370×109 m3) has been criticized for assuming a discovery trend over the next twenty years that would reverse the observed trend of the past 40 years. Their 95% confidence EUR of 2,300 billion barrels (370×109 m3) assumed that discovery levels would stay steady, despite the fact that discovery levels have been falling steadily since the 1960s. That trend of falling discoveries has continued in the ten years since the USGS made their assumption. The 2000 USGS is also criticized for introducing other methodological errors, as well as assuming 2030 production rates inconsistent with projected reserves.[5]

Unconventional sources

Syncrude’s Mildred Lake mine site and plant near Fort McMurray, Alberta

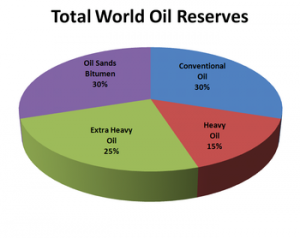

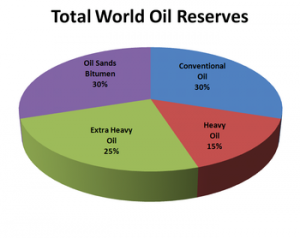

Unconventional sources, such as heavy crude oil, oil sands, and oil shale are not counted as part of oil reserves. However, with rule changes by the SEC,[65] oil companies can now book them as proven reserves after opening a strip mine or thermal facility for extraction. These unconventional sources are more labor and resource intensive to produce, however, requiring extra energy to refine, resulting in higher production costs and up to three times more greenhouse gas emissions per barrel (or barrel equivalent) on a “well to tank” basis or 10 to 45% more on a “well to wheels” basis, which includes the carbon emitted from combustion of the final product.[66][67]

While the energy used, resources needed, and environmental effects of extracting unconventional sources has traditionally been prohibitively high, the three major unconventional oil sources being considered for large scale production are the extra heavy oil in the Orinoco Belt of Venezuela,[68] the Athabasca Oil Sands in the Western Canadian Sedimentary Basin,[69] and the oil shales of the Green River Formation in Colorado, Utah, and Wyoming in the United States.[70][71] Energy companies such as Syncrude and Suncor have been extracting bitumen for decades but production has increased greatly in recent years with the development of Steam Assisted Gravity Drainage and other extraction technologies.[72]

Chuck Masters of the USGS estimates that, “Taken together, these resource occurrences, in the Western Hemisphere, are approximately equal to the Identified Reserves of conventional crude oil accredited to the Middle East.”[73] Authorities familiar with the resources believe that the world’s ultimate reserves of unconventional oil are several times as large as those of conventional oil and will be highly profitable for companies as a result of higher prices in the 21st century.[74] In October 2009, theUSGS updated the Orinoco tar sands (Venezuela) recoverable “mean value” to 513 billion barrels (8.16×1010 m3), with a 90% chance of being within the range of 380-652 billion barrels (103.7×109 m3), making this area “one of the world’s largest recoverable oil accumulations”.[75]

Unconventional resources are much larger than conventional ones.[76]

Despite the large quantities of oil available in non-conventional sources, Matthew Simmons argues that limitations on production prevent them from becoming an effective substitute for conventional crude oil. Simmons states that “these are high energy intensity projects that can never reach high volumes” to offset significant losses from other sources.[77] Another study claims that even under highly optimistic assumptions, “Canada’s oil sands will not prevent peak oil,” although production could reach 5,000,000 bbl/d (790,000 m3/d) by 2030 in a “crash program” development effort.[78]

Moreover, oil extracted from these sources typically contains contaminants such as sulfur and heavy metals that are energy-intensive to extract and can leave tailings – ponds containing hydrocarbon sludge – in some cases.[66][79]The same applies to much of the Middle East’s undeveloped conventional oil reserves, much of which is heavy, viscous, and contaminated with sulfur and metals to the point of being unusable.[80] However, recent high oil pricesmake these sources more financially appealing.[53] A study by Wood Mackenzie suggests that within 15 years all the world’s extra oil supply will likely come from unconventional sources.[81]

[edit]Synthetic sources

A 2003 article in Discover magazine claimed that thermal depolymerization could be used to manufacture oil indefinitely, out of garbage, sewage, and agricultural waste. The article claimed that the cost of the process was $15 per barrel.[82] A follow-up article in 2006 stated that the cost was actually $80 per barrel, because the feedstock that had previously been considered as hazardous waste now had market value.[83]

A 2007 news bulletin published by Los Alamos Laboratory proposed that hydrogen (possibly produced using hot fluid from nuclear reactors to split water into hydrogen and oxygen) in combination with sequestered CO2 could be used to produce methanol, which could then be converted into gasoline. The press release stated that in order for such a process to be economically feasible, gasoline prices would need to be above $4.60 “at the pump” in U.S. markets. Capital and operational costs were uncertain mostly because the costs associated with sequestering CO2 are unknown.[84]

Production

OPEC Crude Oil Production 2002-2006 (in 1,000s barrels/day). Source: Middle East Economic Survey

The point in time when peak global oil production occurs defines peak oil. This is because production capacity is the main limitation of supply. Therefore, when production decreases, it becomes the main bottleneck to the petroleumsupply/demand equation.

World wide oil discoveries have been less than annual production since 1980.[5] According to several sources, worldwide production is past or near its maximum.[4][5][6][8] World population has grown faster than oil production. Because of this, oil production per capita peaked in 1979 (preceded by a plateau during the period of 1973-1979).[32]

The increasing investment in harder-to-reach oil is a sign of oil companies’ belief in the end of easy oil.[45] Additionally, while it is widely believed that increased oil prices spur an increase in production, an increasing number of oil industry insiders are now coming to believe that even with higher prices, oil production is unlikely to increase significantly beyond its current level. Among the reasons cited are both geological factors as well as “above ground” factors that are likely to see oil production plateau near its current level.[85]

Recent work points to the difficulty of increasing production even with vastly increased investment in exploration and production, at least in mature petroleum regions. A 2008 Journal of Energy Security analysis of the energy return on drilling effort in the United States points to an extremely limited potential to increase production of both gas and (especially) oil. By looking at the historical response of production to variation in drilling effort, this analysis showed very little increase of production attributable to increased drilling. This was due to a tight quantitative relationship of diminishing returns with increasing drilling effort: as drilling effort increased, the energy obtained per active drill rig was reduced according to a severely diminishing power law. This fact means that even an enormous increase of drilling effort is unlikely to lead to significantly increased oil and gas production in a mature petroleum region like the United States.[86]

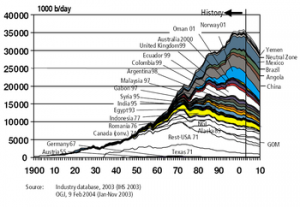

[edit]Worldwide production trends

World oil production growth trends were flat from 2005 to 2008. According to a January 2007 International Energy Agency report, global supply (which includes biofuels, non-crude sources of petroleum, and use of strategic oil reserves, in addition to crude production) averaged 85.24 million barrels per day (13.552×106 m3/d) in 2006, up 0.76 million barrels per day (121×103 m3/d) (0.9%), from 2005.[87] Average yearly gains in global supply from 1987 to 2005 were 1.2 million barrels per day (190×103 m3/d) (1.7%).[87] In 2008, the IEA drastically increased its prediction of production decline from 3.7% a year to 6.7% a year, based largely on better accounting methods, including actual research of individual oil field production throughout the world.[88]

[edit]Oil field decline

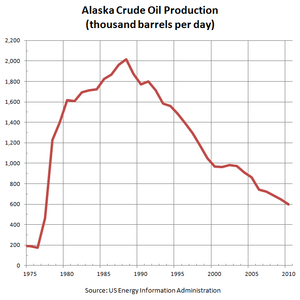

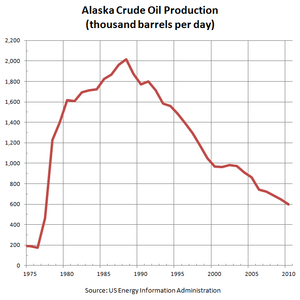

Alaska’s oil production has declined 65% since peaking in 1988

Of the largest 21 fields, at least 9 are in decline.[89] In April 2006, a Saudi Aramco spokesman admitted that its mature fields are now declining at a rate of 8% per year (with a national composite decline of about 2%).[90] This information has been used to argue that Ghawar, which is the largest oil field in the world and responsible for approximately half of Saudi Arabia’s oil production over the last 50 years, has peaked.[53][91] The world’s second largest oil field, the Burgan field in Kuwait, entered decline in November 2005.[92]

According to a study of the largest 811 oilfields conducted in early 2008 by Cambridge Energy Research Associates (CERA), the average rate of field decline is 4.5% per year. The IEA stated in November 2008 that an analysis of 800 oilfields showed the decline in oil production to be 6.7% a year, and that this would grow to 8.6% in 2030.[93] There are also projects expected to begin production within the next decade that are hoped to offset these declines. The CERA report projects a 2017 production level of over 100 million barrels per day (16×106 m3/d).[94]

Kjell Aleklett of the Association for the Study of Peak Oil and Gas agrees with their decline rates, but considers the rate of new fields coming online—100% of all projects in development, but with 30% of them experiencing delays, plus a mix of new small fields and field expansions—overly optimistic.[95] A more rapid annual rate of decline of 5.1% in 800 of the world’s largest oil fields was reported by the International Energy Agency in their World Energy Outlook 2008.[96]

Mexico announced that its giant Cantarell Field entered depletion in March 2006,[97] due to past overproduction. In 2000, PEMEX built the largest nitrogen plant in the world in an attempt to maintain production through nitrogen injection into the formation,[98] but by 2006, Cantarell was declining at a rate of 13% per year.[99]

OPEC had vowed in 2000 to maintain a production level sufficient to keep oil prices between $22–28 per barrel, but did not prove possible. In its 2007 annual report, OPEC projected that it could maintain a production level that would stabilize the price of oil at around $50–60 per barrel until 2030.[100] On November 18, 2007, with oil above $98 a barrel, King Abdullah of Saudi Arabia, a long-time advocate of stabilized oil prices, announced that his country would not increase production to lower prices.[101] Saudi Arabia’s inability, as the world’s largest supplier, to stabilize prices through increased production during that period suggests that no nation or organization had the spare production capacity to lower oil prices. The implication is that those major suppliers who had not yet peaked were operating at or near full capacity.[53]

Commentators have pointed to the Jack 2 deep water test well in the Gulf of Mexico, announced 5 September 2006,[102] as evidence that there is no imminent peak in global oil production. According to one estimate, the field could account for up to 11% of U.S. production within seven years.[103] However, even though oil discoveries are expected after the peak oil of production is reached,[104] the new reserves of oil will be harder to find and extract. The Jack 2 field, for instance, is more than 20,000 feet (6,100 m) under the sea floor in 7,000 feet (2,100 m) of water, requiring 8.5 kilometers (5.3 mi) of pipe to reach. Additionally, even the maximum estimate of 15 billion barrels (2.4×109 m3) represents slightly less than 2 years of U.S. consumption at present levels.[18]

Control over supply

Entities such as governments or cartels can reduce supply to the world market by limiting access to the supply through nationalizing oil, cutting back on production, limiting drilling rights, imposing taxes, etc. International sanctions, corruption, and military conflicts can also reduce supply.

[edit]Nationalization of oil supplies

Another factor affecting global oil supply is the nationalization of oil reserves by producing nations. The nationalization of oil occurs as countries begin to deprivatize oil production and withhold exports. Kate Dourian, Platts’ Middle East editor, points out that while estimates of oil reserves may vary, politics have now entered the equation of oil supply. “Some countries are becoming off limits. Major oil companies operating in Venezuela find themselves in a difficult position because of the growing nationalization of that resource. These countries are now reluctant to share their reserves.”[105]

According to consulting firm PFC Energy, only 7% of the world’s estimated oil and gas reserves are in countries that allow companies like ExxonMobil free rein. Fully 65% are in the hands of state-owned companies such as Saudi Aramco, with the rest in countries such as Russia and Venezuela, where access by Western European and North American companies is difficult. The PFC study implies political factors are limiting capacity increases in Mexico, Venezuela, Iran, Iraq, Kuwait, and Russia. Saudi Arabia is also limiting capacity expansion, but because of a self-imposed cap, unlike the other countries.[106] As a result of not having access to countries amenable to oil exploration, ExxonMobil is not making nearly the investment in finding new oil that it did in 1981.[107]

[edit]Cartel influence on supply

OPEC is an alliance between 12 diverse oil producing countries (Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela) to control the supply of oil. OPEC’s power was consolidated as various countries nationalized their oil holdings, and wrested decision-making away from the “Seven Sisters,” (Anglo-Iranian, Socony-Vacuum, Royal Dutch Shell, Gulf, Esso, Texaco, and Socal) and created their own oil companies to control the oil. OPEC tries to influence prices by restricting production. It does this by allocating each member country a quota for production. All 12 members agree to keep prices high by producing at lower levels than they otherwise would. There is no way to verify adherence to the quota, so every member faces the same incentive to ‘cheat’ the cartel.[108] Washington kept the oil flowing and gained favorable OPEC policies mainly by arming, and propping up Saudi regimes. According to some, the purpose for the second Iraq war is to break the back of OPEC and return control of the oil fields to western oil companies.[109]

Alternately, commodities trader Raymond Learsy, author of Over a Barrel: Breaking the Middle East Oil Cartel, contends that OPEC has trained consumers to believe that oil is a much more finite resource than it is. To back his argument, he points to past false alarms and apparent collaboration.[63] He also believes that peak oil analysts are conspiring with OPEC and the oil companies to create a “fabricated drama of peak oil” to drive up oil prices and profits. It is worth noting oil had risen to a little over $30/barrel at that time. A counter-argument was given in the Huffington Post after he and Steve Andrews, co-founder of ASPO, debated on CNBC in June 2007.[110]

[edit]Timing of peak oil

In Feb 2010 the US Joint Forces Command issued the Joint Operating Environment 2010[111] warning US military commands “By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day.”

“A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. To what extent conservation measures, investments in alternative energy production, and efforts to expand petroleum production from tar sands and shale would mitigate such a period of adjustment is difficult to predict. One should not forget that the Great Depression spawned a number of totalitarian regimes that sought economic prosperity for their nations by ruthless conquest.”

“Energy production and distribution infrastructure must see significant new investment if energy demand is to be satisfied at a cost compatible with economic growth and prosperity.”

“The discovery rate for new petroleum and gas fields over the past two decades (with the possible exception of Brazil) provides little reason for optimism that future efforts will find major new fields.”

International Energy Agency prediction of future oil

The military warning of timing issue is graphically noted in the International Energy Agency’s (IEA) World Energy Outlook 2010.[112] The IEA graph notes that depleting conventional oil will be replaced by “fields yet to be found” and “fields yet to be developed.”

M. King Hubbert initially predicted in 1974 that peak oil would occur in 1995 “if current trends continue.”[113] However, in the late 1970s and early 1980s, global oil consumption actually dropped (due to the shift to energy-efficient cars,[114] the shift toelectricity and natural gas for heating,[115] and other factors), then rebounded to a lower level of growth in the mid 1980s. Thus oil production did not peak in 1995, and has climbed to more than double the rate initially projected. This underscores the fact that the only reliable way to identify the timing of peak oil will be in retrospect. However, predictions have been refined through the years as up-to-date information becomes more readily available, such as new reserve growth data.[116] Predictions of the timing of peak oil include the possibilities that it has recently occurred, that it will occur shortly, or that a plateau of oil production will sustain supply for up to 100 years. None of these predictions dispute the peaking of oil production, but disagree only on when it will occur.

According to Matthew Simmons, former Chairman of Simmons & Company International and author of Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy, “…peaking is one of these fuzzy events that you only know clearly when you see it through a rear view mirror, and by then an alternate resolution is generally too late.”[117]